Paradise Well

| 20 | Boe/d average |

| 10% | Working interest |

| 34.6 MBBLS | 1P |

| 40.5 MBBLS | 2P |

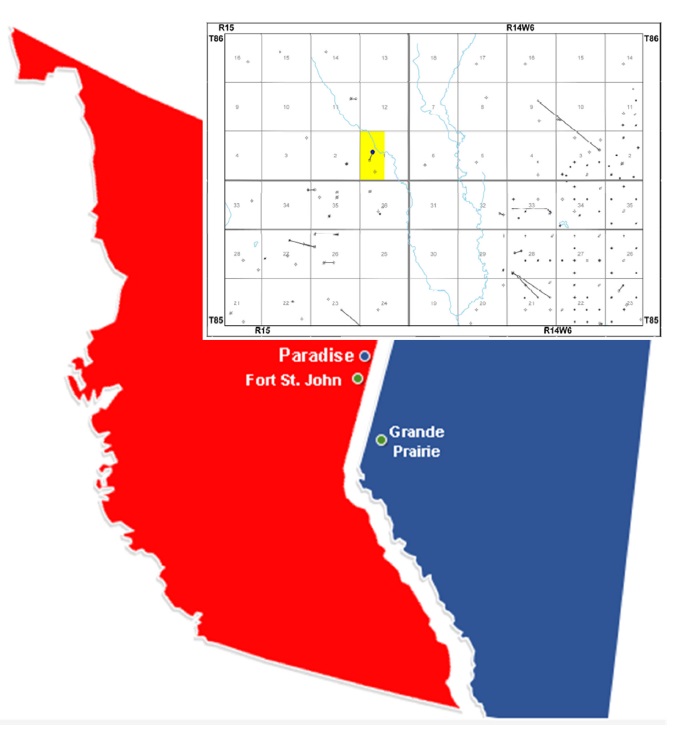

Paradise, British Columbia (Oil)

Twp. 86 Rge. 15W6

Land: ½ Section – 100% WI in the Charlie Lake

Formation

Well: 100/11-01-086-15W6/0 (UWI)

Battery Site: 05-01-086-15W6

Production: 16 bbl/d (100% oil) Boundary Lake well

offsetting the Boundary Lake “A” Pool

Low Annual Decline Rate

NOI: ~$405,000 (Netback: $70.14/boe)

Calima holds a 100% working interest in a half section of land (only subject to Crown royalties) in the

Charlie Lake Formation.

The Property offsets the Boundary Lake “A” pool which has produced over 240.0 million barrels of oil

and 173.4 Bcf of natural gas since 1955.